How to not lose money while buying a car?

Buying a new car has always been a big thing for people in India. For most people, it is the second biggest investment after real estate. So people generally do a lot of research while buying their new car. The research could start from setting the budget to finalising the type of car. However, you can save a lot of money if you exactly know how cars are taxed in India. What are these taxations? In today’s article, let’s talk about car taxes.

Basic understanding

So, when a car manufacturer says that a vehicle is Rs 10 lakhs for ex-showroom, it will include the total taxation. So this tax is made up of GST and Cess. Here GST is fixed at 28% for all petrol, diesel, CNG, LPG, hybrid and all other fuel-consuming cars, whereas it is only 5% for all pure electric vehicles. For electric cars, there is no cess and for fuel-powered vehicles, it varies depending on the type of car and its engine size.

Taxes on different categories

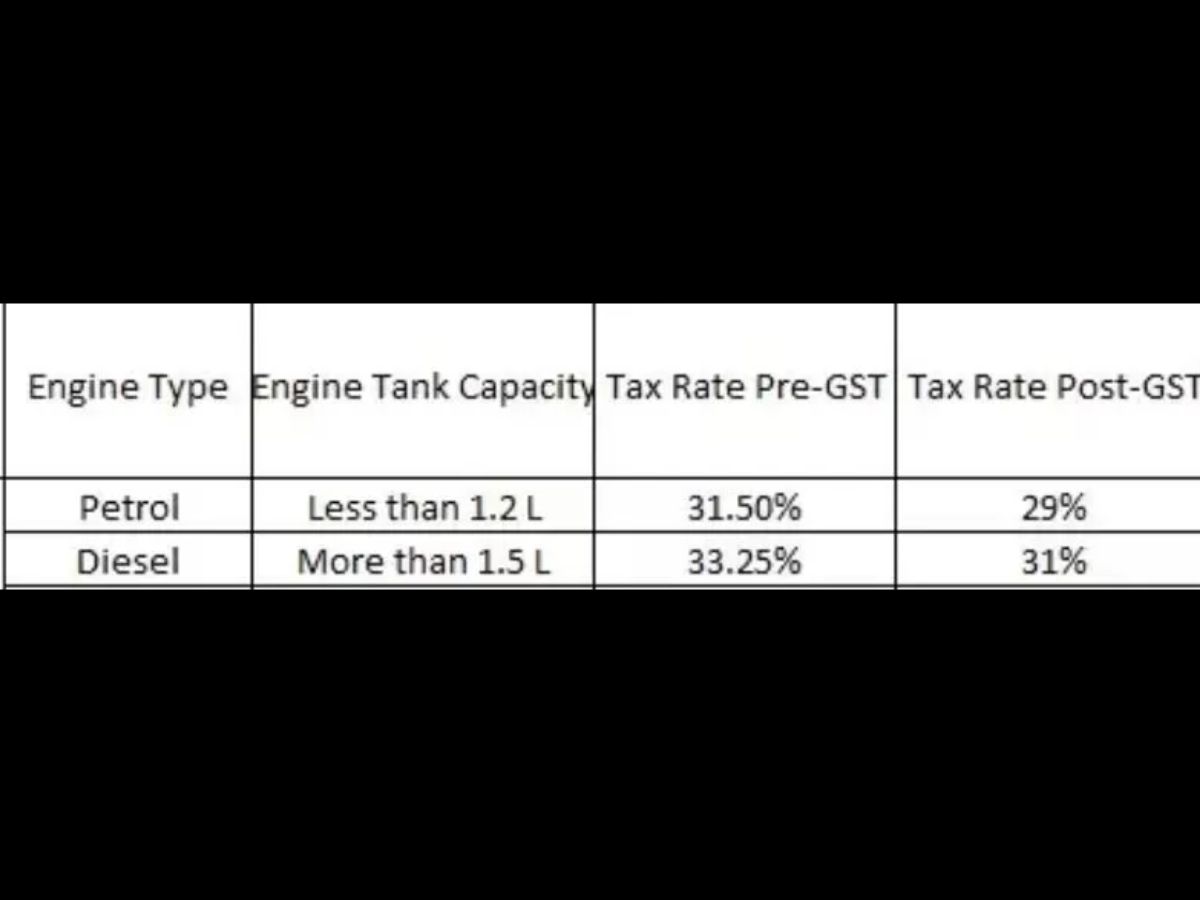

Now let’s talk about the cess charges that vary depending on different parameters. First, let’s talk about compact vehicles – in India, these are vehicles that are under 4 metres in length. Compact vehicles include small hatchbacks (Maruti Alto, Renault Kwid), mid-size hatchbacks (Maruti Celerio, Maruti WagonR), full-size hatchbacks (Maruti Baleno, Tata Altroz, Hyundai i20), compact sedans (Maruti Dzire, Hyundai Aura, Honda Amaze) and compact SUVs (Hyundai Venue, Tata Nexon, Kia Sonet). So now compact cars with less than 1200cc petrol engines attract a cess of 1% with total applied duty being 28 (GST) + 1 = 29%. Let’s take the Nexon XE petrol, which is priced at Rs 7.59 lakhs (ex-showroom). So Tata, on behalf of buyers, is paying a tax of 29%, which translates to Rs 1.70 lakhs on the car, and the original cost of the car without taxes is Rs 5.88 lakhs.

Similarly, for compact vehicles with a diesel engine below 1500cc, 2% more tax is added than similar petrol cars with the total applied tax being 31%. Let’s again take the example of the Nexon XE Diesel, which is priced at Rs 9.89 lakh (ex-showroom). So Tata, on behalf of buyers is paying a tax of 31%, which translates to Rs 2.34 lakhs on the car and the original cost of the car is 7.54 lakhs.

Now let’s talk about longer cars that are over 4-metres, but have an engine capacity below 1500cc. Let us call them big cars to differentiate them from compact ones. This includes cars like the Hyundai Creta, Kia Carens, Maruti Ertiga, and Kia Seltos. Also, the Maruti Brezza is categorised in this segment due to its bigger engine. In this category, Cess is 17%, with total applied duty being 28+17 = 45%. Here let’s take the example of the Hyundai Creta E, which is priced at Rs 10.44 lakh (ex-showroom). So Hyundai, on behalf of buyers is paying a tax of 45%, which translates to Rs 4.69 lakh on the car, and the original cost is Rs 7.20 lakh.

Now, big cars with an engine larger than 1500cc – this gets the likes of Toyota Innova, Kia Carnival, Hyundai Alcazar with petrol engine etc. On such cars, cess is 20%, with total applied duty being 48%. Let’s take the example of Toyota Innova, which is priced at Rs 18.08 lakh (ex-showroom). In this, the tax is 5.86 lakhs, and the original cost is 12.21 lakhs.

For the above-mentioned big cars, if their ground clearance is more than 169mm in laden (which means that the ground clearance is measured by making everyone in its capacity sit inside), then the Cess increase by a further 2%. So, 28 + 20 + 2 = 50%. Which are these vehicles? This includes the Jeep Meridian, Toyota Fortuner and Mahindra XUV700, Tata Safari. Let’s take an example, of the Toyota Fortuner, which is priced at Rs 32.58 lakh (ex-showroom). In this, the tax is 11.86 lakh, and the original cost of the car is 23.72 lakh.

Lastly, we have hybrid cars with a cess of 15%, with a total applied duty being 48%, which doesn’t have any length or engine size. We only have a few cars in this segment, like the Maruti Grand Vitara, Toyota Urban Cruiser HyRyder, Camry and the Honda City Hybrid. Here let’s take the City hybrid, which is priced at Rs 19.92 lakhs. This tax is 6.46 lakhs, and the original cost of the car is 13.45 lakhs. So, a City hybrid and even a Toyota Camry, despite the difference in size and engine have the same taxation.

Car taxes – How can you save money?

We hope we can guide you on the different taxations on different sizes of cars and their engines. These have been made to reduce air pollution as bigger engines make more pollution and bigger size vehicles take up more space in the city for parking. Hence, if you are looking to reduce the carbon footprint of your vehicle or pay lesser in taxes you should go for a compact size petrol or diesel vehicle. Then there are the EVs also. How much tax did you pay on your car?

If you have car buying doubts click here to ask! Get the lowest price for car insurance here. For more such content stay subscribed to MotorOctane Youtube, Google News Facebook, and Twitter. Also, follow us on Flipboard and Reddit where we have a discussion community.

Comments