Your favourite car will become expensive soon!

Cars have always been an expensive proposition in India. A lot of factors play a part in it, from government taxes to dealer markup. So is there any end to such high prices? Apparently not, as the government has issued a draft notification regarding third-party insurance premiums. In today’s article, we will discuss how your favourite vehicles will become more expensive starting next month.

New insurance rate

The Ministry of Road Transport and Highway (MoRTH) has notified that it will be increasing third-party insurance premiums. This change will be applicable for various categories of vehicles starting from 1st June. What does third-party insurance cover? This insurance covers things other than own damage and is mandatory for all cars. It covers collateral damage to a third party in the event of a road accident.

So what are the revised rates?

The revised rates are according to the engine capacity. Private cars with an engine capacity of 1000cc will have to pay an insurance premium of Rs 2,094, compared to Rs 2,072 in 2020. In the 1000cc to 1500cc category, cars will have a premium of Rs 3,416 from 3,221. Meanwhile, cars above 1,500cc will have a premium of Rs 7,897. Two-wheelers over 150cc but not exceeding 350cc have a premium of Rs 1,366, and for over 350cc the premium is Rs 2,804.

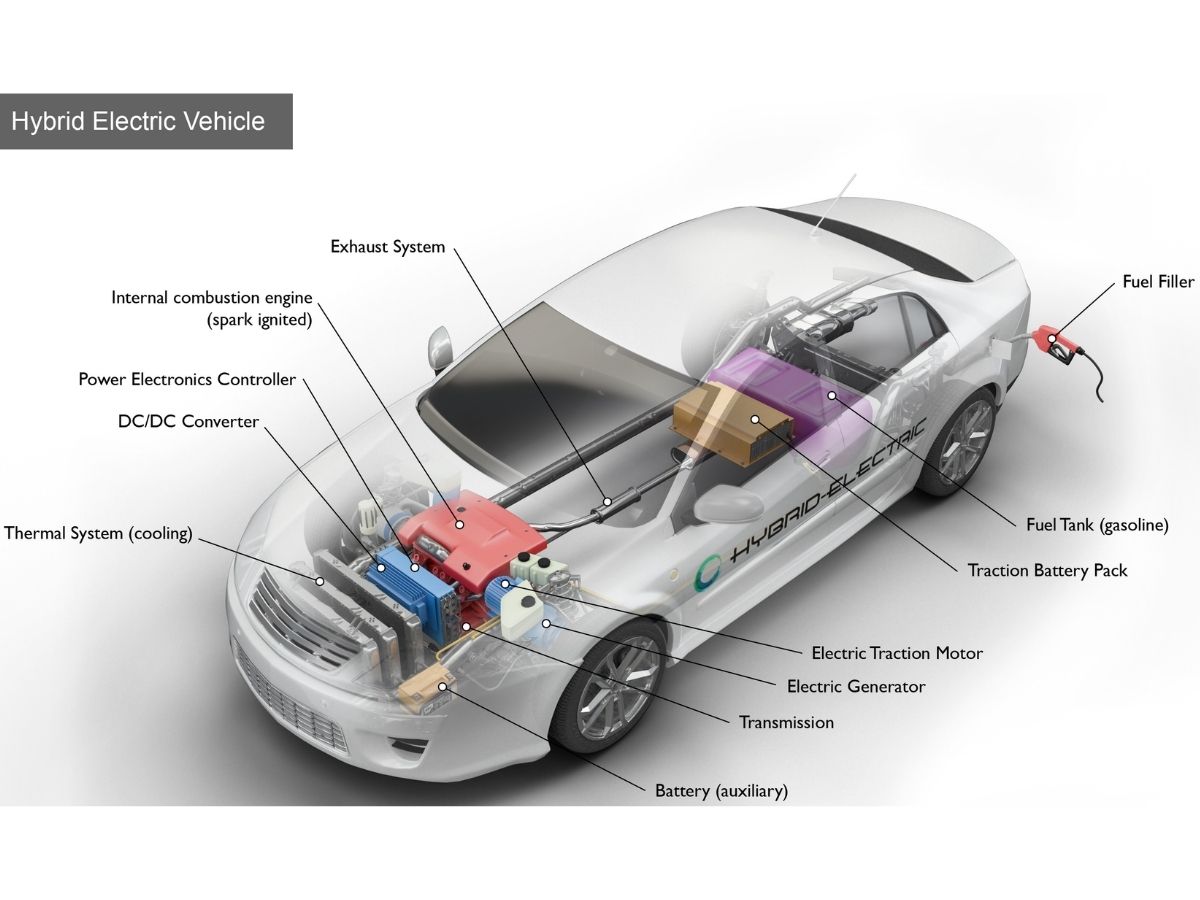

Third-party insurance- Hybrid and EV concessions

The government is giving some concessions on hybrids and EVs to promote their growth. Government is giving a discount of 7.5% on hybrid electric vehicles. Electric vehicles not exceeding 30kW will have a premium of Rs 1,780, and those exceeding 30kW but not 65kW will attract a premium of Rs 2,904.

If you have car buying doubts click here to ask! Get the lowest price for car insurance here. For more such content stay subscribed to MotorOctane Youtube, Google News Facebook, and Twitter. Also, follow us on Flipboard and Reddit where we have a discussion community.

Comments