Why are cars expensive in India?

If you have recently purchased a new car, it’s not only a joyous occasion for you and your family, it’s a bigger occasion for the government as well, as they collect various taxes from the car you just bought. In this article, we will discuss why cars are expensive in India and how taxes play a major role in making them expensive.

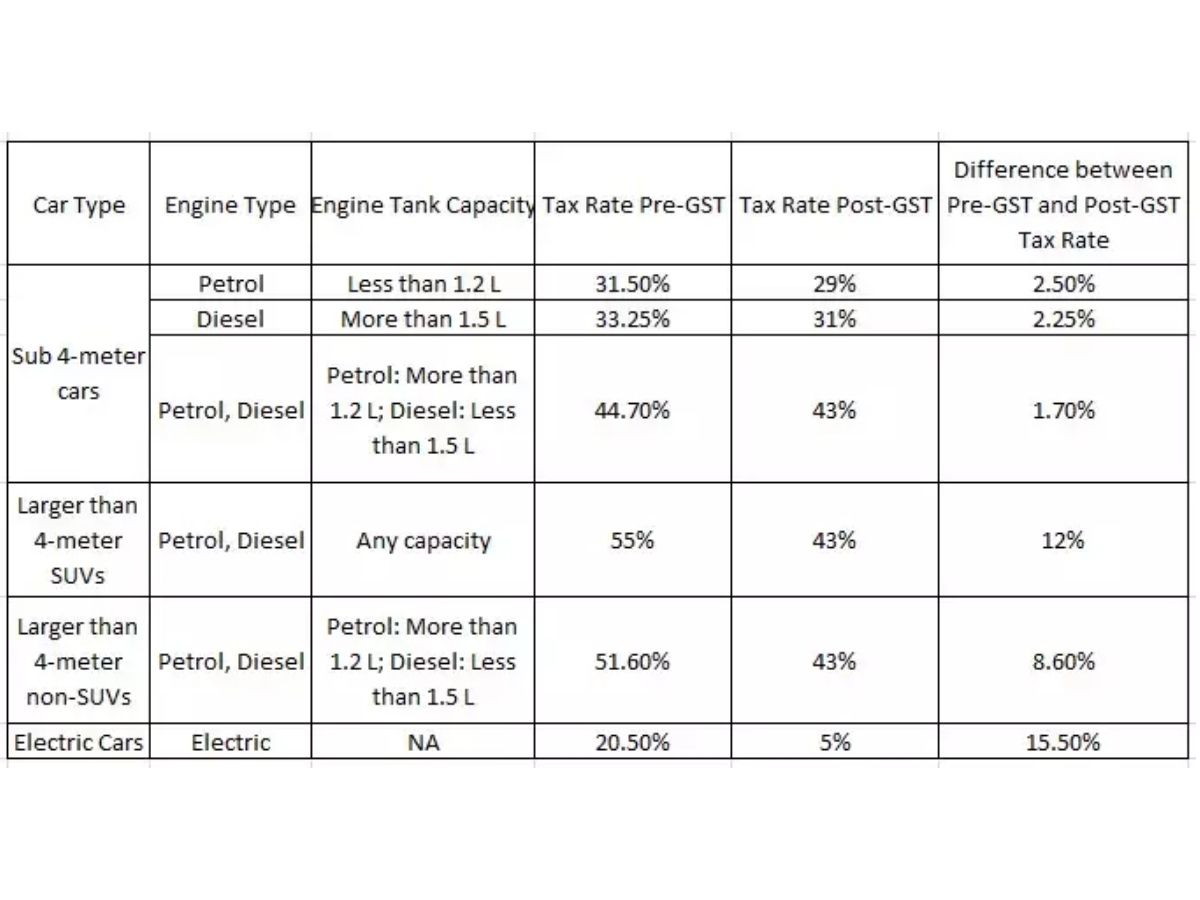

GST Rates on Cars

GST varies from 29 percent to almost 50 percent based on the car and its engine. Vehicles that are sub-four-metre & have a petrol engine that is less than 1.2-litre, the taxes are calculated at 28 percent GST and one percent CESS, totalling to 29 percent. Similarly, this tax differs from vehicle to vehicle, based on the length, type of fuel, and engine capacity.

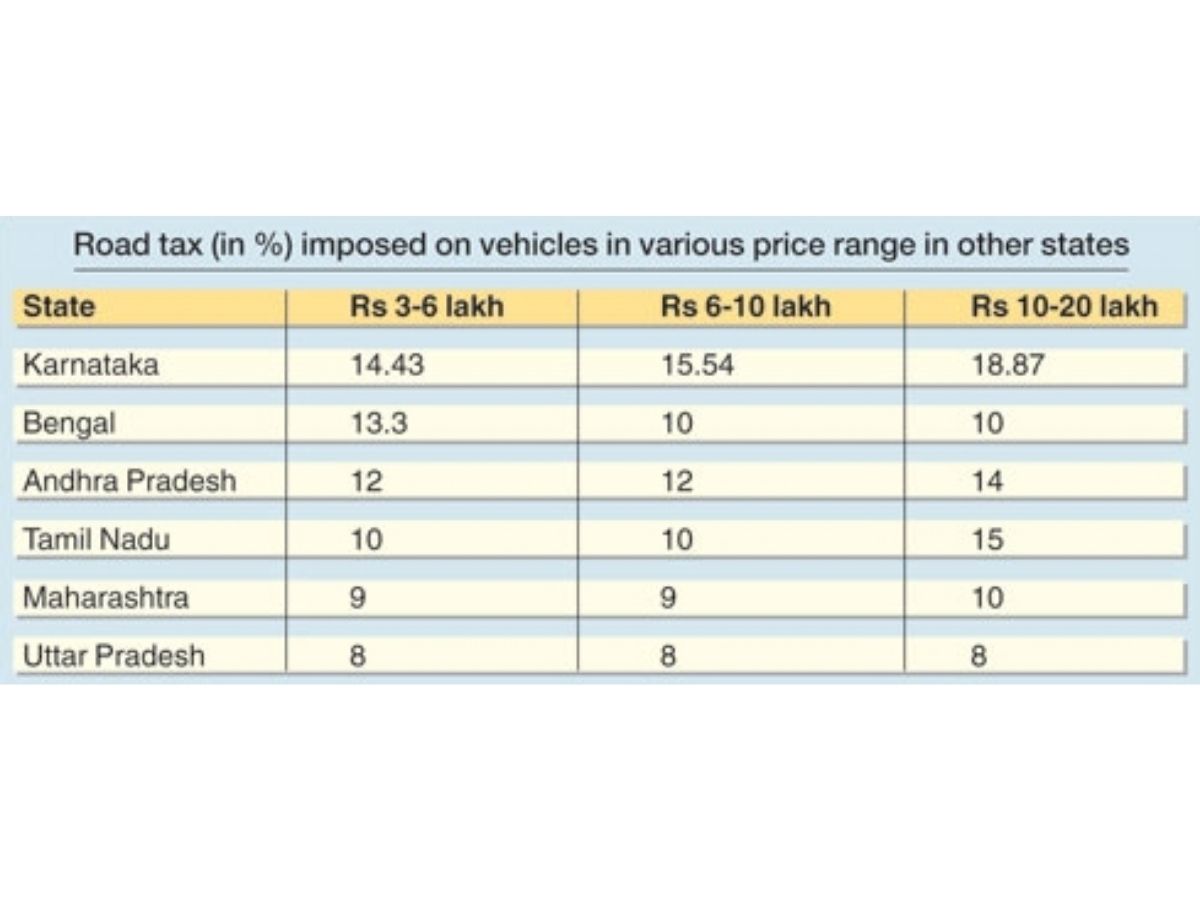

Road Tax and Registration Charges

State government applies road tax and this differs from state to state depending on the type of the car, the fuel it uses and the engine capacity. Registration charges are applicable when you buy a new vehicle as well as when you buy a used vehicle.

Expensive cars in India – Excise Duty on Fuel

The car that you buy operates on fuel (petrol, diesel or CNG). But you pay excise duty on the fuel that you use for your car which ranges from 35 percent to 45 percent of the fuel price.

Other Charges and Taxes

You also pay 18 percent GST when you pay for insurance renewal, servicing, and when you buy parts & accessories. Taxes are an inevitable part once you have purchased a car.

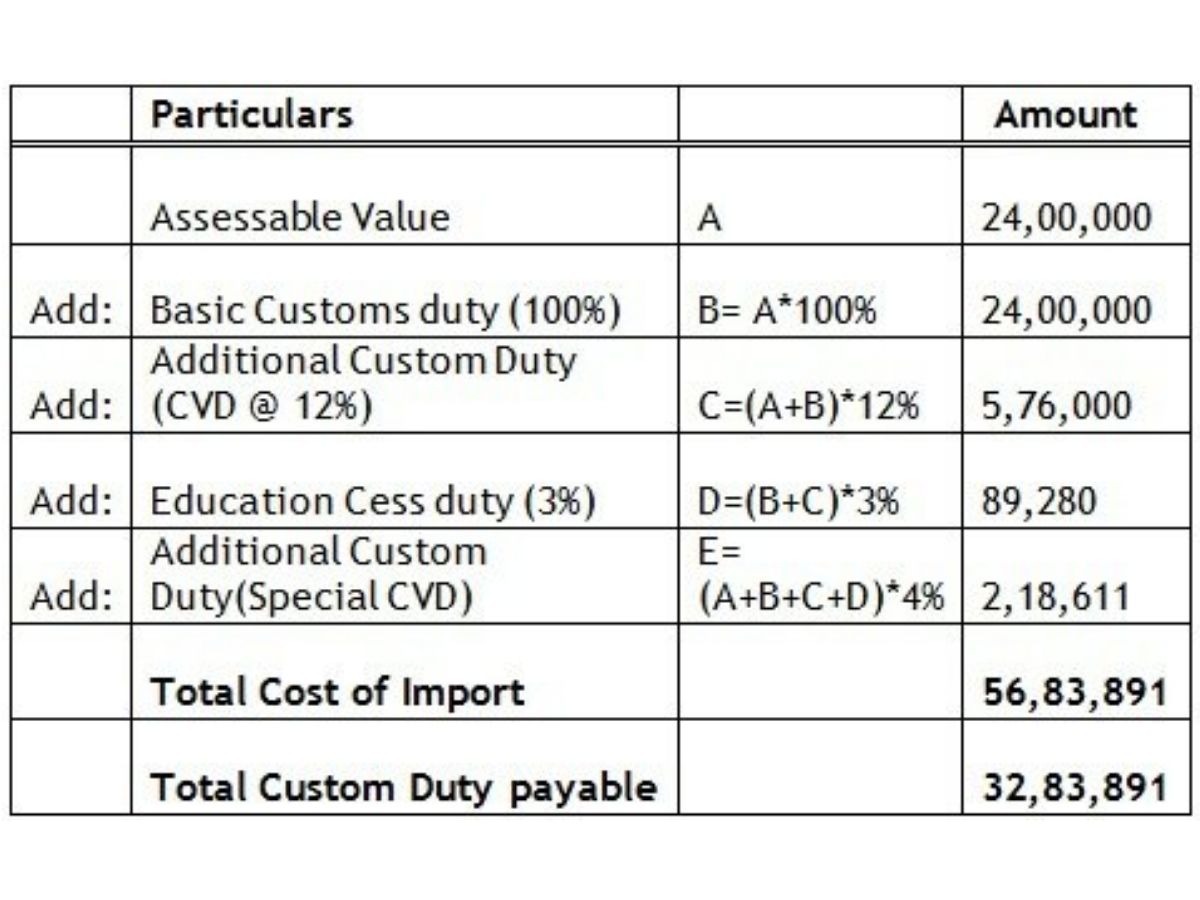

Expensive cars in India – Import Duty

Currently, India imposes 100 percent duty on fully imported cars with CIF ( Cost, Insurance and Freight) value more than USD 40,000 and 60% on those costing less than the amount as explained in the table above. If you buy a car worth Rs 24 lakh, you would end up paying Rs 56,83,891 as the cost of importing this car to India and another Rs 32,83,891 as custom duty, making the car super expensive at Rs 1,13,67,782.

Cost of Parts

Sometimes the car is not imported as CBU (Complete Built-Up) unit. Usually, parts are imported and later assembled in India and treated as CKD (Complete Knock Down) units. Parts imported under the CKD arrangement also attract heavy taxes. For engine or gearbox mechanism in pre-assembled form but not mounted on a chassis or a body assembly, the import duty is calculated at 30 percent. While engine, gearbox, and transmission mechanism not in a pre-assembled condition are charged with 10 percent import duty.

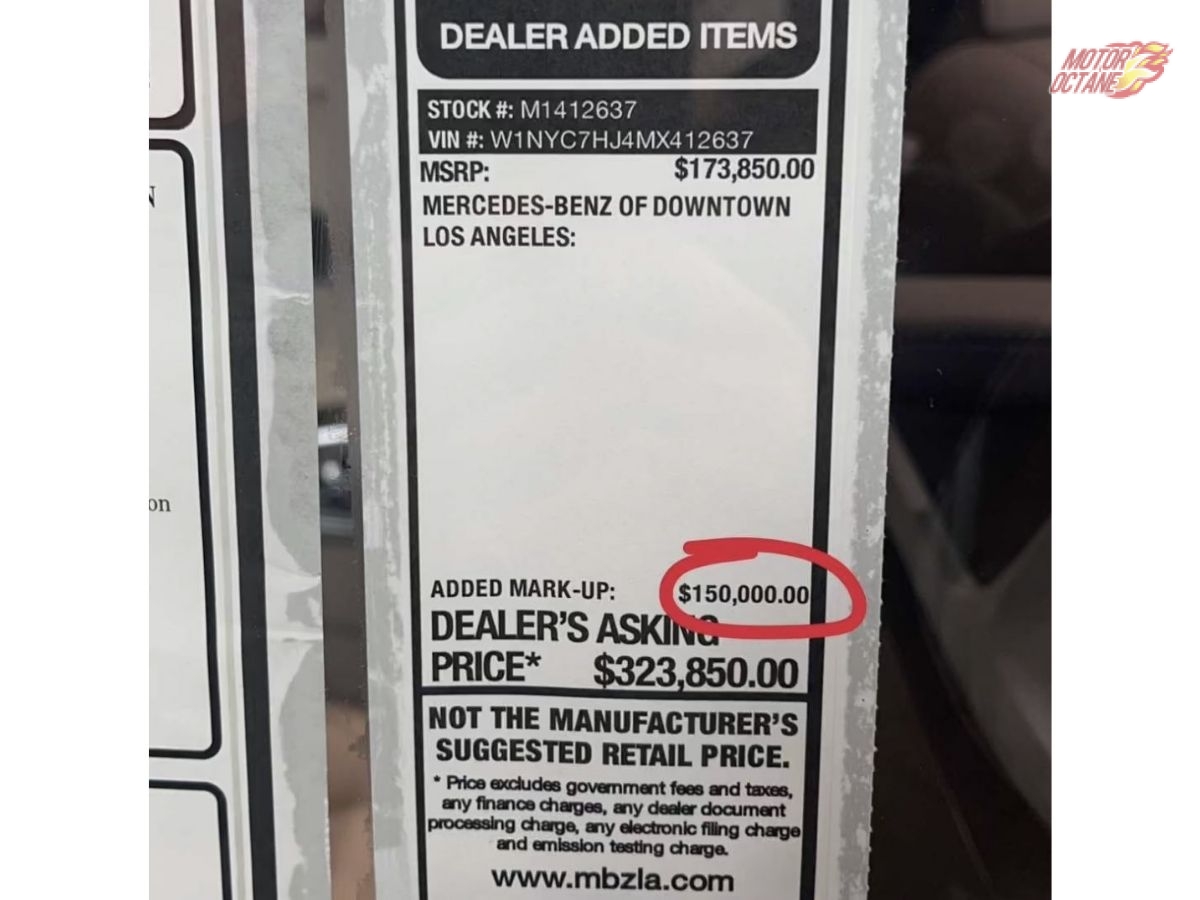

Expensive cars in India – Dealer Markup

Very few people know about the term ‘Dealer Markup’. This refers to the cost, margins to the price of the vehicle. The amount of markup allowed to the retailer determines the money he makes from selling every unit of product. Higher the markup, greater the cost to the consumer, and greater the money the retailer makes. This also acts as a factor that makes cars expensive in India.

If you have car buying doubts click here to ask! Get the lowest price for car insurance here. For more such content stay subscribed to MotorOctane Youtube, Google News Facebook, and Twitter. Also, follow us on Flipboard and Reddit where we have a discussion community.

Comments