Electric vs Petrol Car – Which is better investment?

With just a few manufacturers entering the EV market, it is now too early for a common person to understand how the EV will perform as an asset. There isn’t strong infrastructure and the upfront cost of an EV seem higher than the ICE counterpart. While the green credentials of the EV are too important to be ignored, we decided to compare ICE versus EV with the help of a few industry experts. We have tried to decipher if Electric cars are a good investment.

Competitors

As the Indian market seems to be fond of SUVs, so for this comparison too we will take the Hyundai Creta to represent the ICE segment and the EV will be represented by 2 cars – Hyundai Kona and MG ZS EV.

For this analysis, we are going to pick Creta in its topmost variant with the 1.4 Turbo GDi SX(O) Metallic with 7-Speed DCT. The on-road price is Rs 20.25 lakhs. Similarly, the Hyundai Kona which comes in 2 variants and the difference limited to the exterior paint, let us round off the price to Rs 24.5 lakhs. Lastly, the MG ZS EV will be considered at Rs 24 lakhs.

All the prices are on-road and the calculation that has been given further is based on assumptions from the current scenario.

Future Assumptions

To start with all these cars have been bought in the year 2020 and will be kept till 2025. So over 5 years, we do expect a rise in petrol and electricity costs. Taking consideration from 2000 the increase in petrol prices has been explained in the table below.

| Petrol Price Delhi | Percentage | |

| 2000 | 25.94 | |

| 2010 | 47.93 | 18.37% |

| 2015 | 66.29 | 38.31% |

| 2020 | 80.43 | 21.33% |

| 2025 | 96.516 | Expect a 20% increase |

For the convenience of calculation let us consider the average petrol price to be Rs 94/litre. Same way, let us assume an average electricity cost per unit Rs 10 for the calculation. As you can see the cost per unit of electricity is much lower than that of petrol.

For 1 Year

The Creta will give you an approximate mileage of 10km/l if you consider of daily driving. Now with the electric cars, the things are that the mileage is considered in terms of km/kW and the Kona does a mileage of 8 and the MG ZS EV does of around 7. With this said on an average a person is going to drive any of these cars for at least 1000 km a month which will round of to 12000 km in 12 months. So these will be your figures for the basic yearly calculations.

Now for the shocking bit if a car runs for 12000 km a year and has the mileage of 10 km/l then the car will use up 1200 litres of fuel. But in terms of Electric vehicle, the number of units used is the cost. This puts the Kona a bit ahead in terms of efficiency. At 1500 units the Kona consumed lesser units compared to MG ZS EV’s 1714 units.

But the difference in the price of petrol and electricity is drastic and this leads to an extreme shift in consumption. So every year where the Creta will cost you Rs 112800 to fuel up the Kona will cost you Rs 15000. Subsequently, the ZS EV will also cost Rs 15000.

Maintaining ICE car is also a bit more costly as there are heat and friction between the main parts and it takes a lot of expensive stuff to just maintain the vehicle. On the other hand, the electric vehicle will only require regular checks for wiring and motor maintenance. The batteries are mostly maintenance-free and if used with caution will last the whole duration of the car ownership. The maintenance of the Hyundai Creta amounts to Rs 15000 and on the other hand the EV cost about Rs 7500.

All this amounts to a total cost of one year to be Rs 127800 for the Hyundai Creta and Rs 22500 for the Hyundai Kona. This basic calculation tells that running and maintaining an EV is much cheaper than a traditional IC engine car. But then it raises the question of the initial cost.

Loan

If the loan amount is kept simple with the same principal amount on all the 3 car then it gives us a much better idea. A loan of 12 lakhs is assumed with 8.5% interest and a term of 5year. Taking a loan on a regular car does not give u any type of benefit but with the EV there is an Income Tax benefit for the loan interest. So if Rs 24,620 is the EMI monthly and the interest amount goes down like in a decreasing fashion. So over a tenure of 5 years, the interest that gets paid is Rs 2,76,000 will be the Income tax benefit for the EV owner.

We should combine the IT benefit with the running cost savings for EV ( as against ICE Creta). All that amounts to Rs 8,02,500 for the Hyundai Kona and Rs 7,91,786 for the ZS EV. This means the upfront extra amount paid for the EV can be recovered in about 2.5 years in both Kona as well as MG ZS

| With IT Benefits | Kona Versus Creta | MG EZ versus Creta Top |

| Price Difference when acquiring the car | 425000 | 375000 |

| Years to recover the difference | 2.6 | 2.4 |

Final Comparison

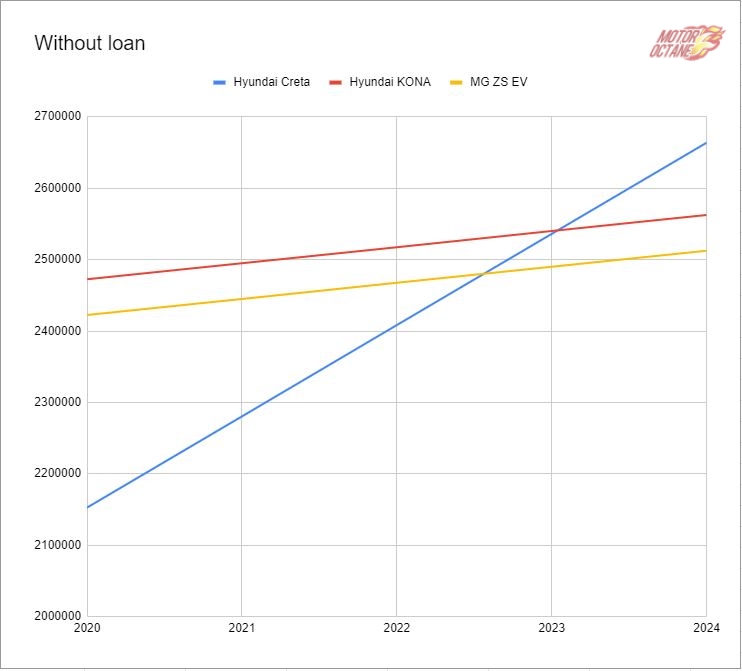

When there is no loan taken

| Without IT benefits /No Loan | Kona Versus Creta | MG EZ versus Creta |

| Price Difference when acquiring the car | Rs 4,25,000 | Rs 3,75,000 |

| Years to recover the difference | 4.0 | 3.6 |

When the cars are bought with no loan and direct payment you spend Rs 4,25,000 more on the Kona and Rs 3,75,00 on the ZS EV. This amount is recovered with the yearly savings of approximately 1,06,250 in a year with the Kona. This result in recovering your money in 4.0 years. Same goes for the MG ZS EV and the recovery is in 3.6 years.

When there is a loan taken

| With IT Benefits – 100% considered | Kona Versus Creta | MG EZ versus Creta |

| Price Difference when acquiring the car | Rs 4,25,00 | 3,75,000 |

| Years to recover the difference | 2.6 | 2.4 |

When you take a loan the story is different and it takes lesser time to recover your original amount. This is because of the IT benefit offered on the loan by the government.

The higher loan amount for Kona/MG ZS compared to Creta

Another scenario is where the loan amount availed is proportionately higher for Kona and MG EV compared to Creta. For example, we assume 20lakhs loan for Kona and MG, while 17 lakhs is assumed for Creta. Here EMI per month for Creta will be lower and hence the time is taken to recover the extra spend for Kona/EZ will be more than 5 years.

Depreciation Calculation

In the current scenario, a vehicle loses about 30-40% of its cost in three years. Hence the residual value would be 60-70% after three years. Although we have limited data points, if we look at the residual value of Tesla which is seen losing 5% every year and extrapolating it to the EVs in this analysis, coupled with the fact that there is lack of supply in the second-hand market for the EV one can expect much higher returns on selling it even after 3 years.

| Residual value after 3 years | Creta | Kona EV | MG EZ Top end |

| Current view ( % of present value) | 70% | 60% | 60% |

| Most likely scenario by 2022 | 60% | 75% | 75% |

Should you consider an EV?

Now if you buying the car without loan then the EV demands more money upfront but the recovery is within 4 years for the Hyundai Kona and 3.6 years for the ZS EV. It’s not the best deal but it does cover the cost within 4 years.

In case of a loan, the EV makes more sense. There is no IT benefit on the ICE car-like Creta whereas the benefit on the EV drastically reduces the time of recovery to 2.6 years. This is of course if the same amount of loan is taken for the car.

This does make it clear that EV makes more sense and saves a lot than the ICE car but it is up to your payment method that will decide how fast you cover up your difference. In all the comparison we need to always remember EVs are environment friendly and that is priceless!

This analysis was done by G Krishna Kumar, Bengaluru based EV owner and columnist, Twitter @gkrishnakumar – Ideator of this entire piece along with Chinmay

Thanks to the critical review and inputs from :

Mr Hormazd Sorabjee (Automotive Industry expert, Twitter: @hormazdsorabjee)

Mr Rachit Hirani (Automotive Industry expert, Twitter: @OctaneAddict)

Mr Srinivas Acharya – EV owner/ enthusiast, Twitter: @rs_acharya

Mr Arun Bhat – (EV owner/ Enthusiast, Twitter: @arunbhats)

2 Comments

-

Well explained . it would have been better if the long drive limitation would have also been explored during the comparo.

Here one important point is missed in the entire discussion, which is if I had bought Creta over Kona or MG, I would have made an FD of the difference amount which is 4L at 6.5% ROI, and the accumulated interest of 4 years would be Rs 1.2L. So, the cost is still not fully recovered and there are many more years to cover.

Now, instead of creating an FD, if I had invested in MF, I would have earned the return of around 2L at 10% .

So, in my view we should also consider/explore the investment options of the difference amount.